- Building MaterialsTrends

- 14 min read

- August 2024

Trends Affecting Online Sales of Building Materials in 2024

Key Takeaways

The demand for building materials is on the rise, driven by increased construction activity and infrastructure development. Also, there is a change in the digital space, where suppliers are opting to order building materials online.

However, many businesses in the building materials sector are struggling to acquire enough customers, particularly as the market shifts increasingly towards digital platforms.

Several key trends will reshape how building materials are bought and sold online in 2024, and companies must adapt to these changes to stay competitive.

The rise of digital technologies, coupled with evolving buyer behaviors, is pushing businesses to rethink their strategies, or they risk losing ground in an industry that is rapidly moving towards online procurement.

Understanding these trends will be crucial for businesses aiming to thrive in a rapidly changing market.

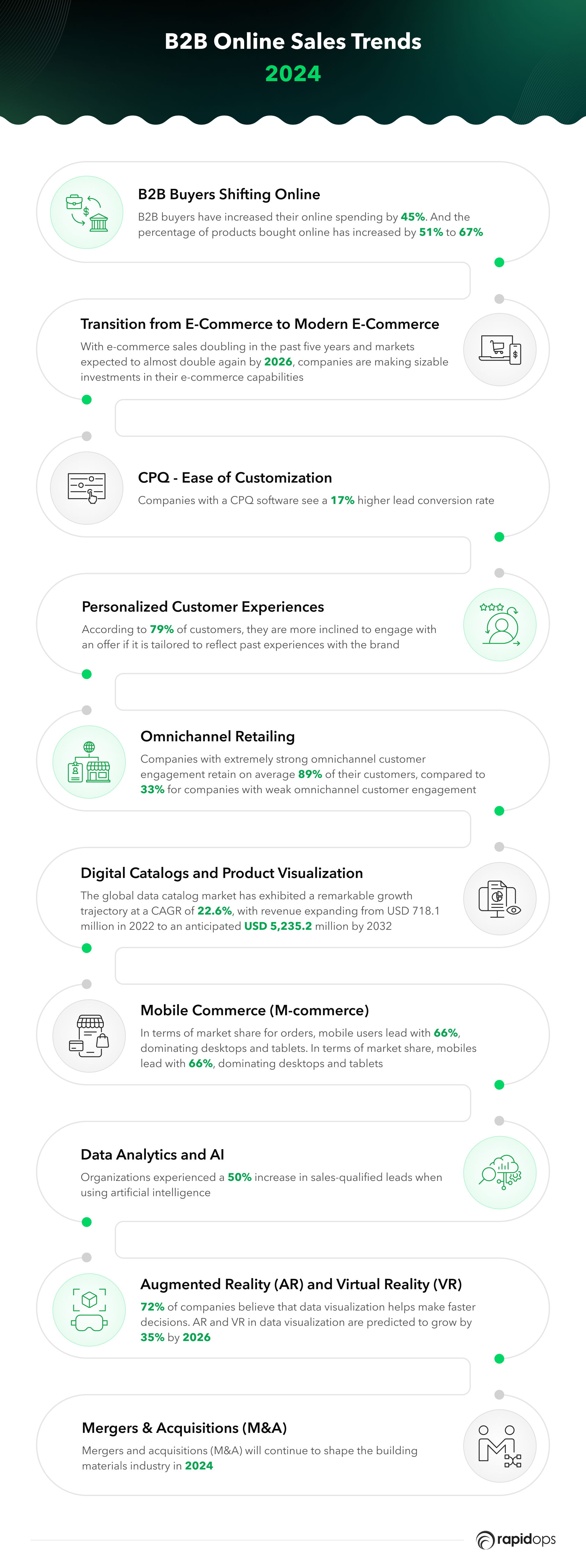

1. B2B buyers shifting online

B2B buyers have increased their online spending by 45%. And the percentage of products bought online has increased by 51% to 67%. - Kurve

B2B buyers in the building materials industry are increasingly moving online to streamline their purchasing processes. The need for efficiency drives this shift, as online platforms offer faster transactions, easier access to product information, and simplified ordering processes.

With the growing complexity of construction projects and tighter deadlines, buyers are seeking ways to reduce the time spent on procurement.

Digital platforms allow them to quickly compare products, check availability, and place orders, all from a single interface. Businesses that fail to transition effectively to digital platforms may struggle to compete as the industry increasingly favors online procurement.

2. Transition from eCommerce to modern eCommerce

With eCommerce sales doubling in the past five years and markets expected to almost double again by 2026, companies are making sizable investments in their eCommerce capabilities. - Brainworks

eCommerce platforms are evolving beyond traditional transactional models into more dynamic and user-centric experiences. This evolution is driven by the need to meet the expectations of modern B2B buyers, who demand more than just basic online transactions.

In 2024, modern eCommerce will be characterized by advanced features such as AI-powered search and discovery, which help buyers quickly find the exact products they need, and generative AI for content creation, which will enable personalized product descriptions and customer support through chatbots.

These features enhance the overall user experience by providing tailored recommendations, flexible payment options, and intuitive interfaces.

For building materials businesses, embracing these innovations is key to meeting the demands of sophisticated B2B buyers and staying competitive in an increasingly digital marketplace.

3. CPQ - Ease of customization

Companies with CPQ software see a 17% higher lead conversion rate - Valorx

As customization becomes increasingly important in B2B sales, Configure, Price, and Quote (CPQ), tools will become essential for building materials businesses in 2024. The growing demand for bespoke building solutions means that buyers expect products tailored to their exact specifications.

CPQ tools simplify this process by enabling customers to configure products to their precise requirements, ensuring accurate pricing and rapid quote generation.

This not only improves customer satisfaction by providing a seamless customization experience but also streamlines sales operations by reducing the time and effort required to finalize deals.

In an industry where precision and speed are critical, CPQ tools will be invaluable in enhancing both.

4. Personalized customer experiences

According to 79 percent of customers, they are more inclined to engage with an offer if it is tailored to reflect past experiences with the brand - NineTailed

Personalization will become a critical factor in 2024 for engaging B2B customers in the building materials industry. With the growing amount of data available, businesses have the opportunity to create highly personalized experiences that cater to their customer's specific needs and preferences.

This could involve targeted product recommendations based on past purchases, customized content that addresses particular pain points, or tailored promotions that resonate with individual buyers.

By leveraging data and technology, companies can create more meaningful interactions that build stronger customer relationships and drive sales.

In a market where buyers have many options, personalization will be key to standing out and fostering loyalty.

5. Omnichannel retailing

Companies with extremely strong omnichannel customer engagement retain, on average, 89% of their customers, compared to 33% for companies with weak omnichannel customer engagement. - PorchMedia

Building materials businesses will need to adopt omnichannel retailing strategies in 2024 to meet the evolving expectations of B2B customers. This trend is driven by the increasing demand for seamless and consistent experiences across multiple touchpoints, whether online, in-store, or through a mobile app.

As buyers move between different channels during their purchasing journey, they expect a unified experience that allows them to interact with the brand consistently and conveniently.

For example, a customer might start by researching products online, visit a physical store to see the materials in person, and then complete the purchase via a mobile app.

By integrating these channels, businesses can enhance customer satisfaction, build loyalty, and ultimately drive sales growth.

6. Digital catalogs and product visualization

The global data catalog market has exhibited a remarkable growth trajectory at a CAGR of 22.6%, with revenue expanding from USD 718.1 million in 2022 to an anticipated USD 5,235.2 million by 2032. - Market US

High-quality digital catalogs and product visualization tools will play a pivotal role in B2B sales of building materials in 2024. As construction projects become more complex, buyers need detailed information and the ability to visualize products in real-world applications before making a purchase.

Digital catalogs make it easy to browse products, access specifications, and compare options, while visualization tools allow customers to see how materials will look in their projects.

This not only aids in making informed purchasing decisions but also reduces the likelihood of returns, as customers can better assess the suitability of the products.

For businesses, investing in these tools is crucial to providing a superior online shopping experience that meets the needs of today's B2B buyers.

7. M-commerce

In terms of market share for orders, mobile users lead with 66%, dominating desktops and tablets. In terms of market share, mobiles lead with 66%, dominating desktops and tablets. - WiserNotify

As mobile devices become the primary tool for online browsing and purchasing, mobile commerce (M-commerce) will gain significant traction in 2024.

The increasing reliance on mobile devices by B2B buyers means that building materials businesses must optimize their websites and digital platforms for mobile use.

This includes ensuring that customers can easily search for products, place orders, and access support on the go.

A well-executed M-commerce strategy will be essential for capturing the growing mobile-driven market and providing a convenient, efficient shopping experience that meets the needs of busy professionals who often make purchasing decisions from job sites or while on the move.

8. Data analytics and artificial intelligence

Organizations experienced a 50% increase in sales-qualified leads when using artificial intelligence - Harvard Business Review

Data analytics and artificial intelligence (AI) will provide businesses in the building materials industry with valuable insights into customer behavior, market trends, and operational efficiencies.

In 2024, these technologies will become even more integral to B2B sales strategies as companies use data to anticipate market shifts, optimize inventory, and personalize customer interactions. AI-driven analytics can reveal patterns and trends that are not immediately apparent, enabling businesses to make more informed decisions and stay ahead of competitors.

For example, predictive analytics can help businesses forecast demand for specific materials, allowing them to manage inventory more effectively and avoid stockouts or overstock situations.

Leveraging data and AI will be a key differentiator for businesses aiming to thrive in a competitive B2B landscape.

9. Augmented reality (AR) and virtual reality (VR)

72% of companies believe that data visualization helps make faster decisions. AR and VR in data visualization are predicted to grow by 35% by 2026. - Linearity

Augmented Reality (AR) and Virtual Reality (VR) technologies will revolutionize the way customers interact with building materials online in 2024.

These technologies allow B2B buyers to visualize products in 3D, assess how they will fit into various projects, and make more confident purchasing decisions.

By providing a realistic, immersive experience, AR and VR reduce the uncertainty that often accompanies online purchases, especially for complex building materials where seeing the product in context is critical.

This enhanced visualization not only improves customer satisfaction but also reduces the likelihood of returns, as buyers can better evaluate products before committing.

For businesses, investing in AR and VR technologies will be essential for staying competitive and meeting the expectations of modern B2B buyers.

10. Mergers & acquisitions (M&A)

Mergers and acquisitions (M&A) will continue to shape the building materials industry in 2024 as companies seek to expand their digital capabilities and customer reach.

The increasing competition and the need to stay relevant in a rapidly digitalizing market are driving businesses to explore strategic partnerships and acquisitions.

By acquiring companies with advanced digital tools, eCommerce platforms, or specialized technologies, building materials businesses can quickly enhance their online presence and offer more comprehensive solutions to their customers.

Beyond expanding digital capabilities, M&As often involve the complex task of integrating different technology stacks, standardizing processes, and aligning corporate cultures.

For example, integrating disparate ERP systems or eCommerce platforms is essential for maintaining a consistent customer experience and operational efficiency.

Additionally, mergers often lead to broader product offerings, necessitating upgrades to e-commerce platforms and product management systems to handle a more diverse catalog.

Supply chain optimization, market expansion, and ensuring regulatory compliance are other critical factors that influence the digital transformation efforts post-merger.

These moves not only help businesses stay competitive but also position them to take advantage of emerging trends in the B2B sales landscape.

Investing in the right digital tools and strategies during and after an M&A can be the key to successfully navigating these challenges and capitalizing on the opportunities that a merger or acquisition presents.

The importance of a digital partner

In an industry where agility and innovation are key, having the right digital partner can make all the difference.

By choosing to collaborate with a digital expert, you ensure that your business is well-equipped to navigate the complexities of the digital age, turning potential disruptions into opportunities for growth and success.

Partnering with a digital product development expert ensures that your business is not only aware of the trends but is also equipped to harness their full potential.

Whether it's adopting modern eCommerce platforms that cater to the specific needs of B2B buyers, integrating AI-driven personalization to enhance customer experiences, or developing robust mobile commerce solutions, a digital partner provides the expertise and technology necessary to keep your business ahead of the curve.

Conclusion

The trends shaping the online sales landscape for building materials in 2024 are fundamentally driven by the need to meet customer demands while ensuring profitability.

In the B2B space, this means delivering a seamless, efficient, and personalized shopping experience that resonates with the unique needs of your business clients.

As the market continues to evolve, the businesses that thrive will be those that embrace innovation and implement the right strategies to stay ahead.

Your customers are not just looking for products—they're seeking solutions that simplify their operations, reduce costs, and enhance their productivity.

By focusing on these customer-centric outcomes and aligning them with a robust, scalable business model, you can ensure your building materials business excels in this rapidly changing market.

With a strong digital partner by your side, such as Rapidops, which has 15+ years' experience in closely working with building materials businesses, your business can confidently tackle the challenges ahead, turning them into opportunities for growth.

Frequently Asked Questions

How does modern e-commerce differ from traditional e-commerce in the context of building materials sales?

What role do mergers and acquisitions play in the digital transformation of building materials businesses?

Why are personalized customer experiences becoming more important in B2B sales of building materials?

How can building materials businesses leverage data analytics and AI to improve their B2B sales strategies?

What’s Inside

- 1. B2B buyers shifting online

- 2. Transition from eCommerce to modern eCommerce

- 3. CPQ - Ease of customization

- 4. Personalized customer experiences

- 5. Omnichannel retailing

- 6. Digital catalogs and product visualization

- 7. M-commerce

- 8. Data analytics and artificial intelligence

- 9. Augmented reality (AR) and virtual reality (VR)

- 10. Mergers & acquisitions (M&A)

- The importance of a digital partner

- Conclusion